Optimize Tax deductions with accuracy

Navigating the complexities of tax compliance under Sections 194Q, 206AB, and 206CCA can be daunting. Businesses face increased scrutiny, higher TDS/TCS rates for non-compliant vendors, and stringent requirements to validate vendor ITR filings. Enhance tax filing process efficiency with a robust RPA-driven tax compliance solution, tailored to address these challenges efficiently.

Our RPA Bots empower organizations to streamline processes, ensuring compliance with minimal manual intervention while maintaining operational excellence.

We understand the Challenges

The Smart Solution

How it Works?

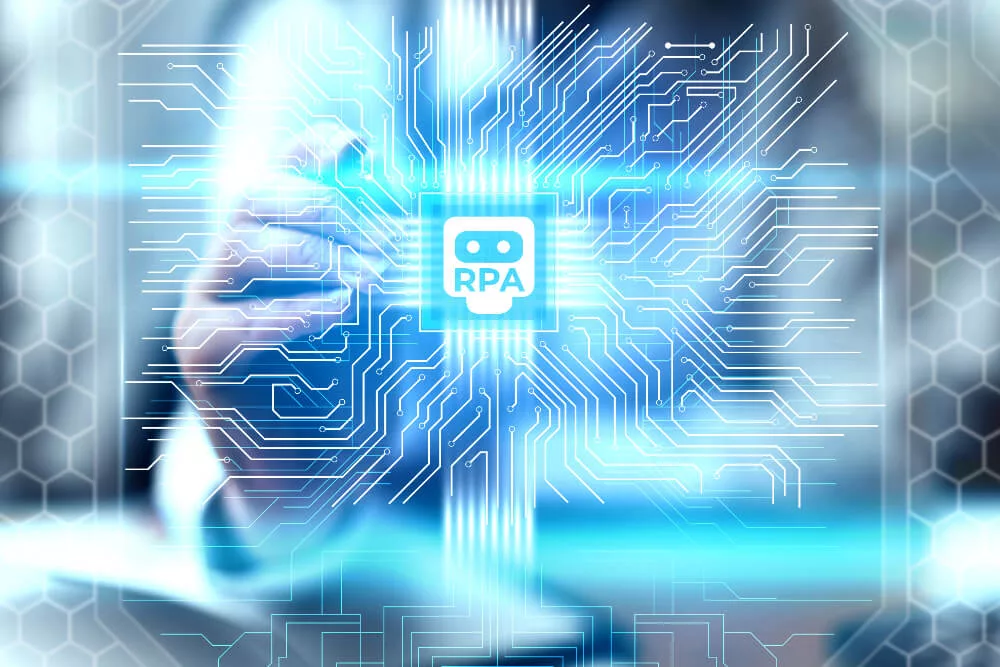

Automated ITR Status (RPA BOT)

Post confirming the customer Turnover

Input PAN & Acknowledgement No.

Fetch ITR Status Per Annum

Show status

Tax return filed

TDS to be deducted at normal

Tax return not filed